Shares: Nasdaq Basic,NYSE ArcaBook,OTC LV1 and LV2 Quotes

Self-developed

Proprietary front and middle office system, fully independent intellectual property rights.

Uptime

24/7 trading system. Comprehensive business monitoring, periodic system failure drills.

System capacity

The system is able to support up to tens of millions of users online and orders per day.

High concurrency

Core data memory processing, able to support TPS1000+, QPS2000+, 90% server response time within 100ms

Scalability

System capacity and concurrency support horizontal expansion.

Stability

Deployment of system supports multi-active mode in different locations. The self-developed intelligent anti-DDoS system ensures a secured and stable platform.

• eGIRO

• Paynow

• FAST

• BigPay

• Telegraphic Transfer

• BigPay

• Telegraphic Transfer

Stocks (US, HK & Singapore)

Us Options

Fractional Shares

Interest Reward

ETFS

FX

Index Options

REITS

Futures

Powerful Data & Advanced Charting

Option: US Option Streaming Quotes

Index: S&P,Dow Jones

LV1 and LV2 Advanced Quotes

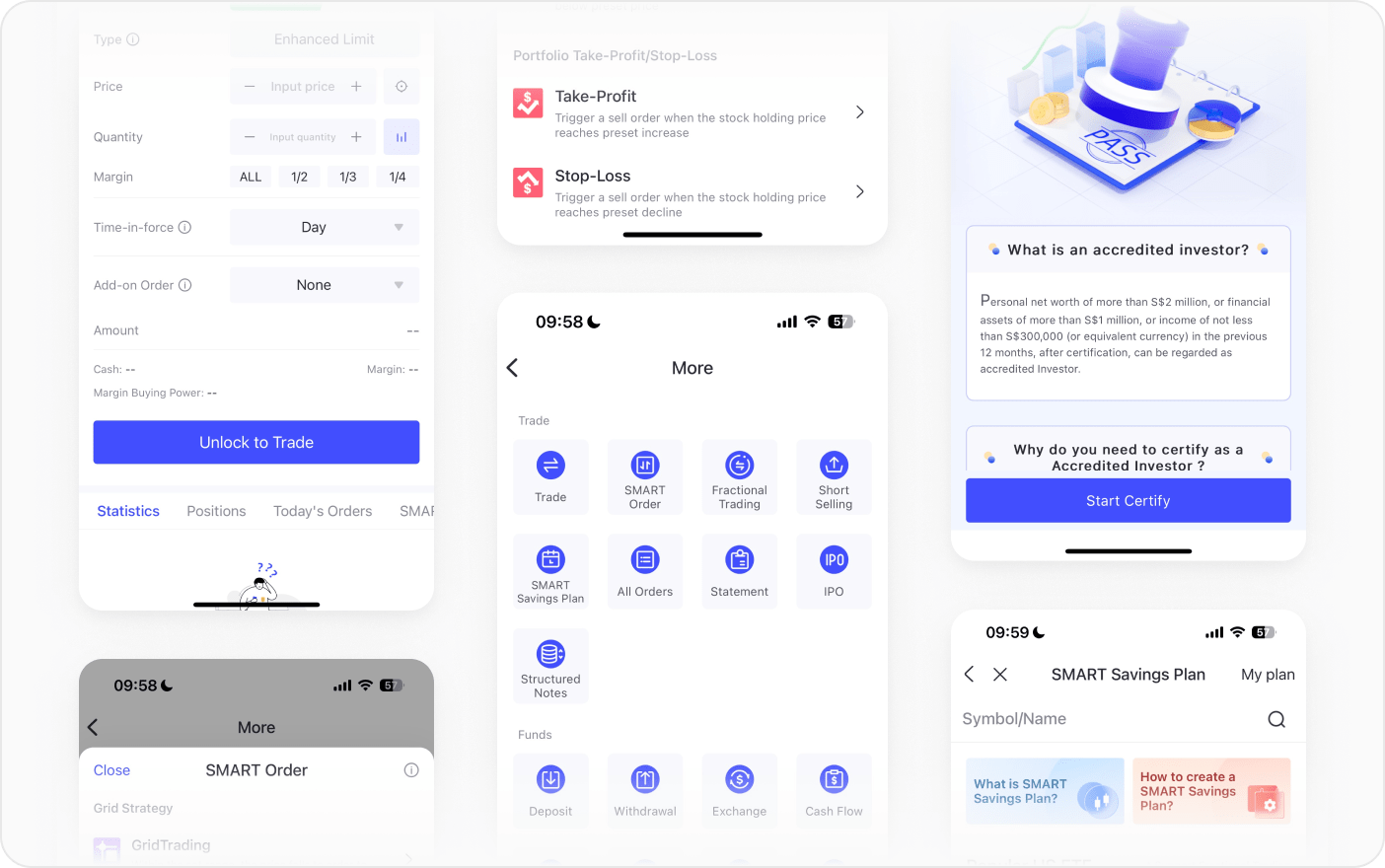

Many More Features

Regular Savings Plan

IPO Application

Accredited Investor Application

Share Transfer In

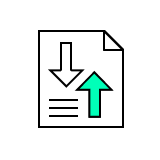

Middle and Back Office System

1. Multiple counterparty management for US stock trading.

2. Counterparties for US stocks report quotes with different tax rates, such as 10% and 30%.

3. Set trading counterparties and tax rates for customers.

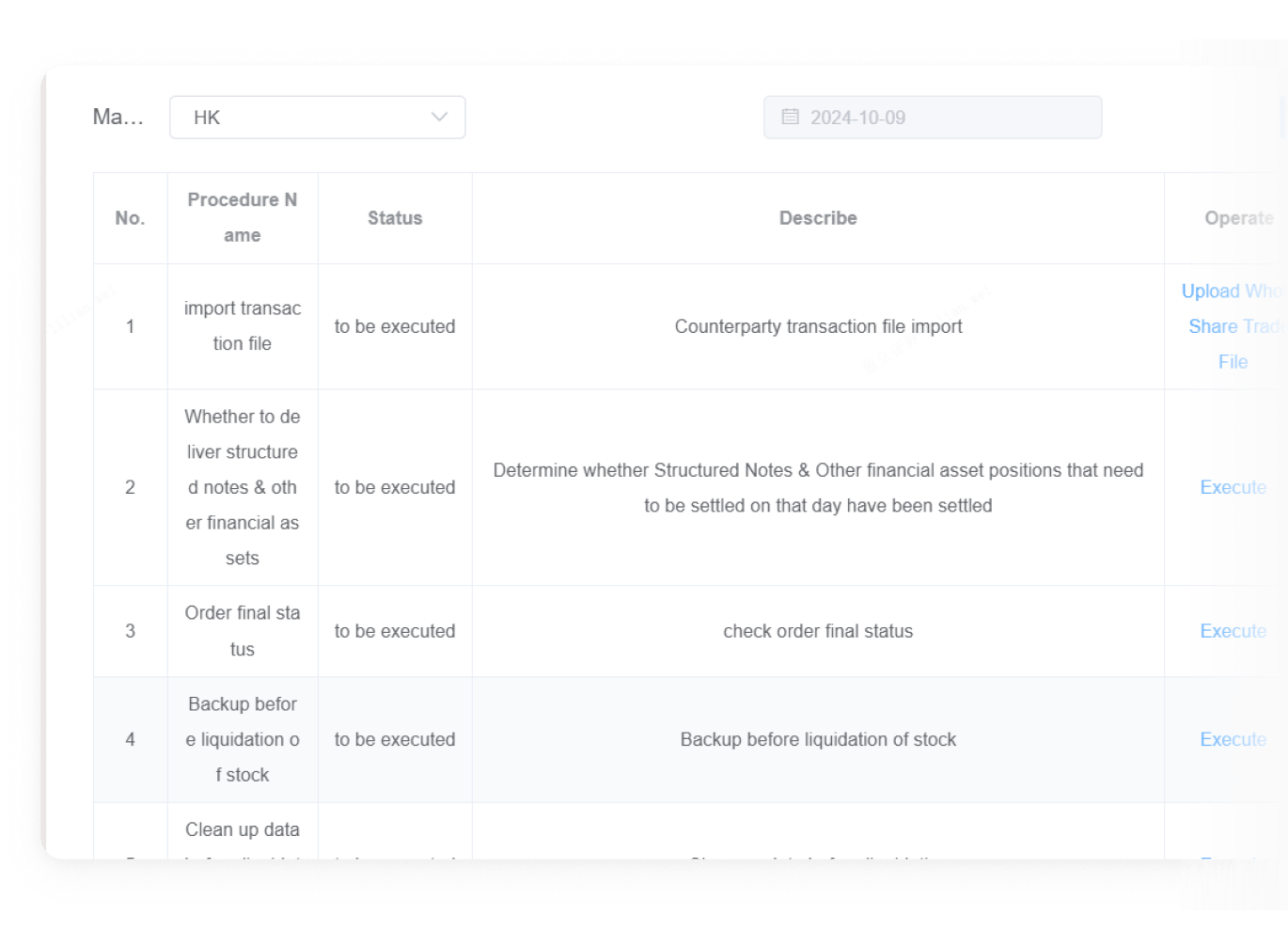

1. Distinguish markets. Each market supports one-click clearing and settlement.

2. Support clearing and settlement for various markets such as US stocks, Singapore stocks, Hong Kong stocks, A-shares, Japanese stocks, etc.

Traders place orders for opening and closing long and short positions in stocks.

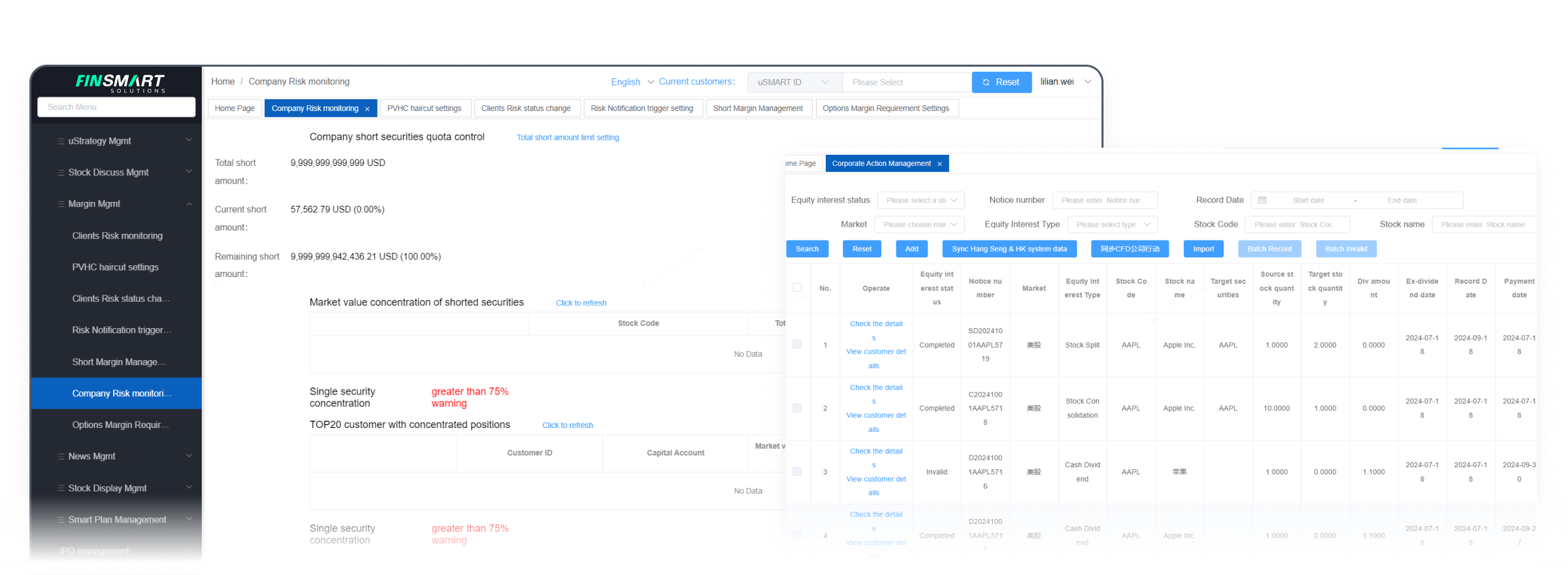

Support the handling of common corporate actions such as cash dividends, stock splits, and reverse stock splits in markets such as Hong Kong, the United States, Singapore stocks, and A-shares.

PVHC-based account risk control system

Customer risk control management

Securities batch leveling

Individual customer financing and securities financing

Indicator settings

Client transaction limit setting

Financing Collateral Ratio Setting

Option strike long and margin ratio management

Stock long and short haircut management

Securities Trading Restriction Setting

Total amount of financing and securities financing control

Account Risk Control Line Setting

Concentration control of single security and client financing and securities financing

SMART Savings Plan

US stock IPO management

Client Statement Mgmt

Share Transfer Mgmt

Currency Exchange Mgmt

Short Selling Trading Transactions

Stock Trading Transaction

Cash Deposit/Withdrawal Review

Individual Acc Open Review

Institutional Account Mgmt

Options Acc Mgmt

Realize the management of accounts, funds, trading and other related businesses after the successful opening of customer accounts.