Advantages

Diversified investment choices

Covering a wide range of investment products such as Public Offering of Fund, Private Fund, bonds, notes, etc., it provides users with a wealth of investment choices to meet the needs of different risk preferences and investment objectives.

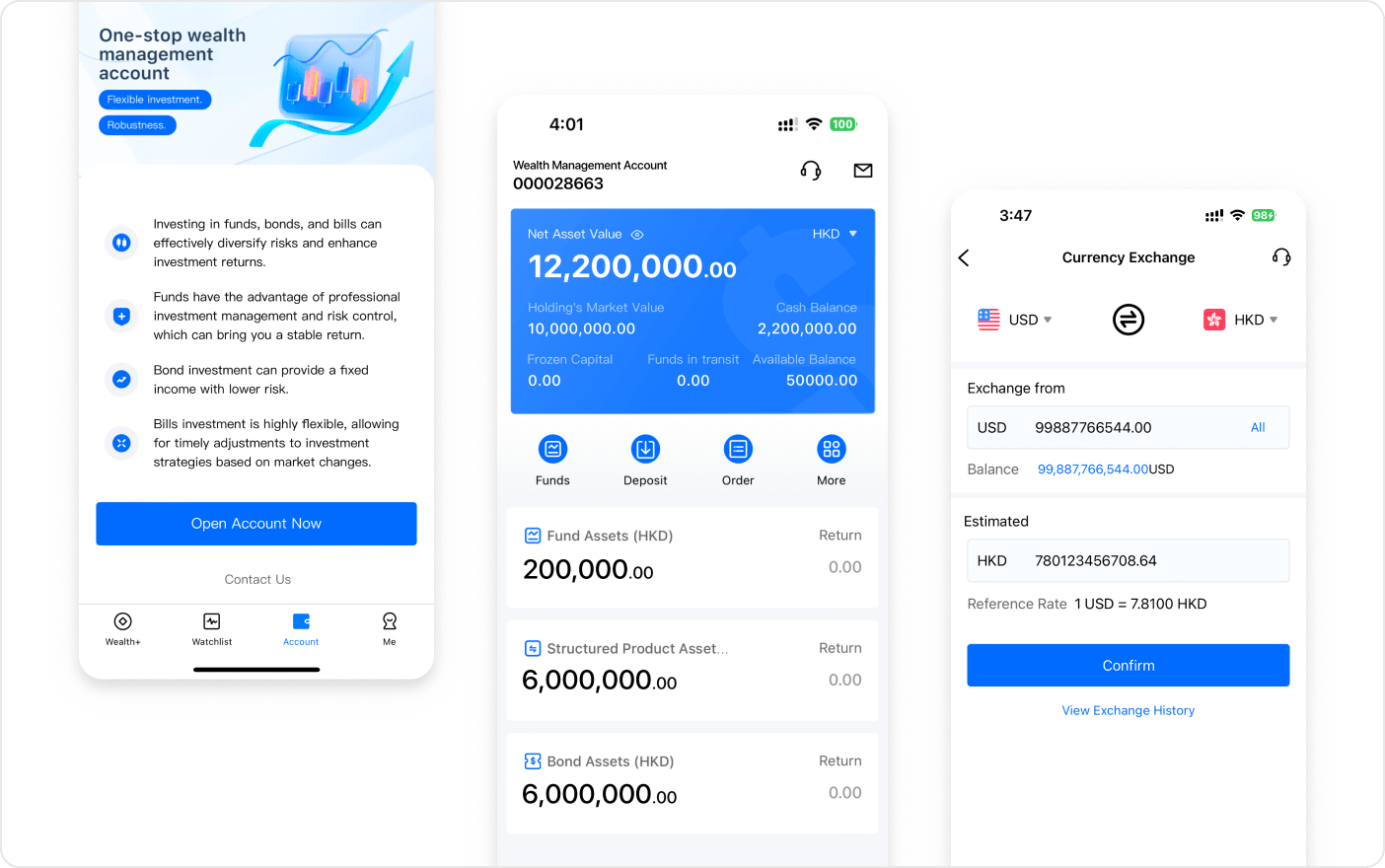

Convenient operation and personalized service

Providing self-selection function, which is convenient for tracking and management. Meanwhile, the functions of exchange and fund transfer are easy to operate, meeting the needs of users in different currencies and fund flows.

Efficient Middle System

Fine management of various types of assets, such as fund management, bond management, note management and other modules ensure standardized operation and efficient monitoring of different assets.

Core Functions

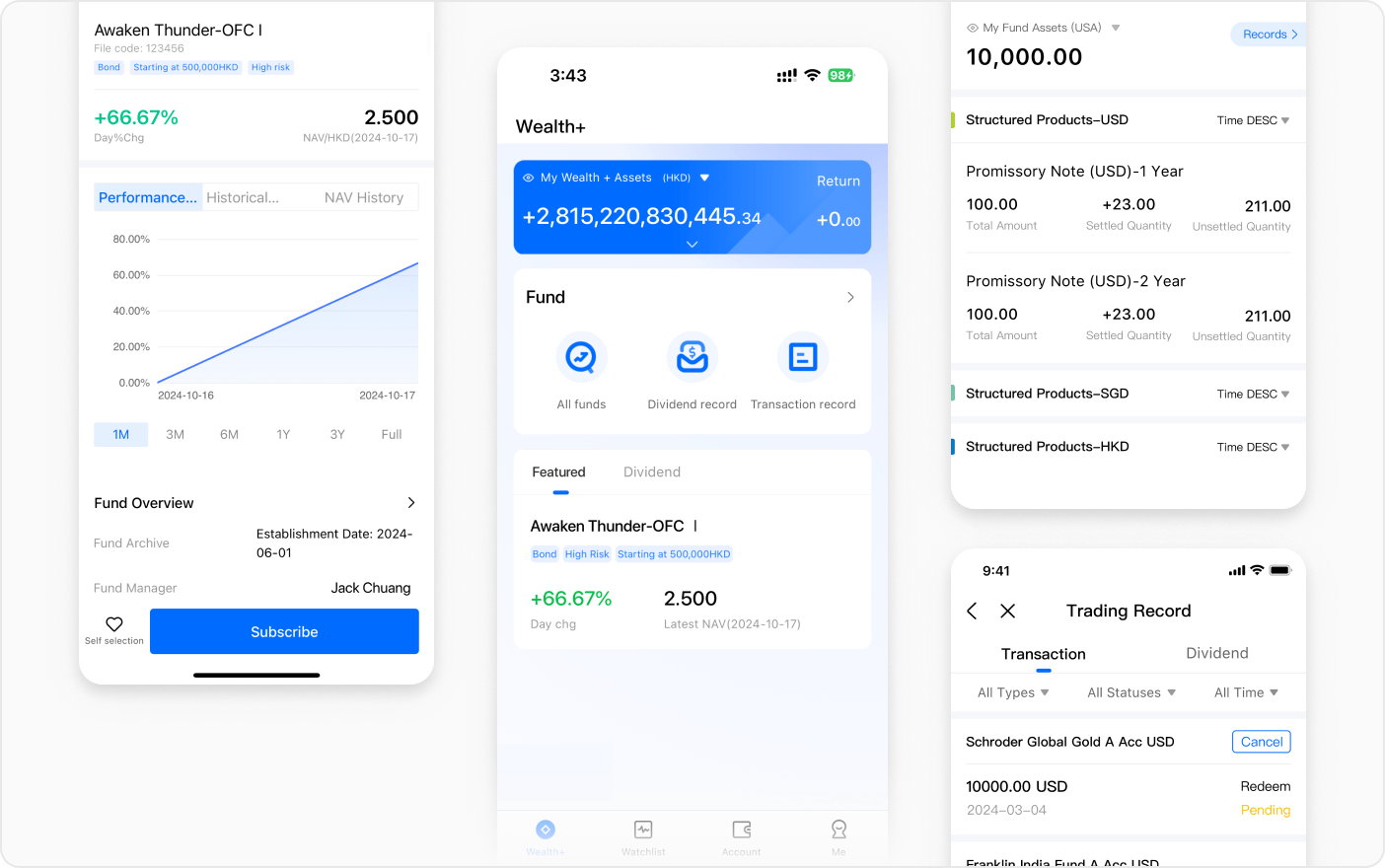

Mobile APP

Wealth Management

Public Offering of Fund

Private Fund

Bonds

Notes

Account

Account opening

Cash Deposit/withdrawal

Currency Exchange

All Transaction

Cash Flow

Risk Test

Statement

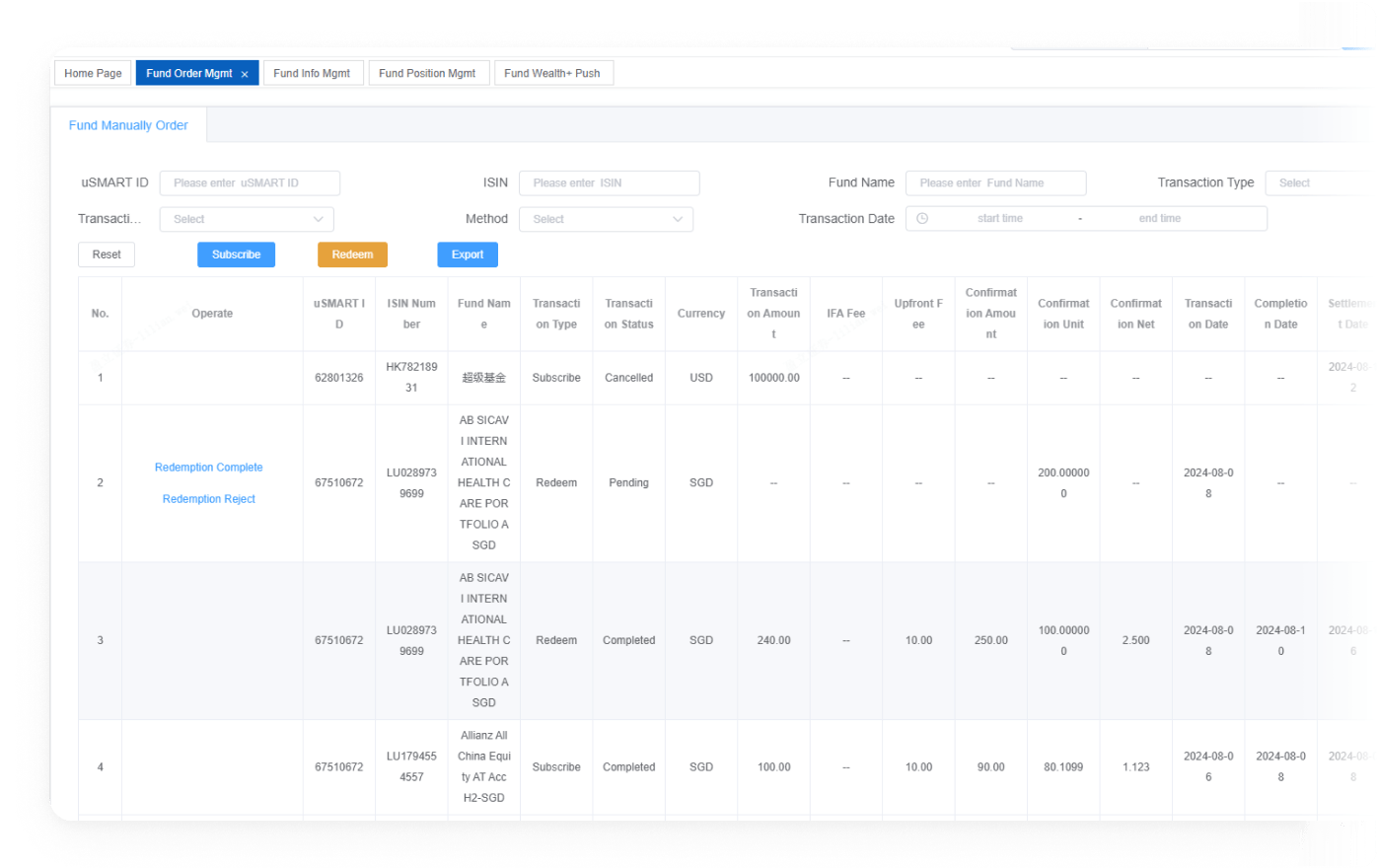

Middle and Back Office System

Funds Management

Fund Counterparty Management

Fund Information Management

Fund Transaction Management

Fund Position Management

Fund Home Release

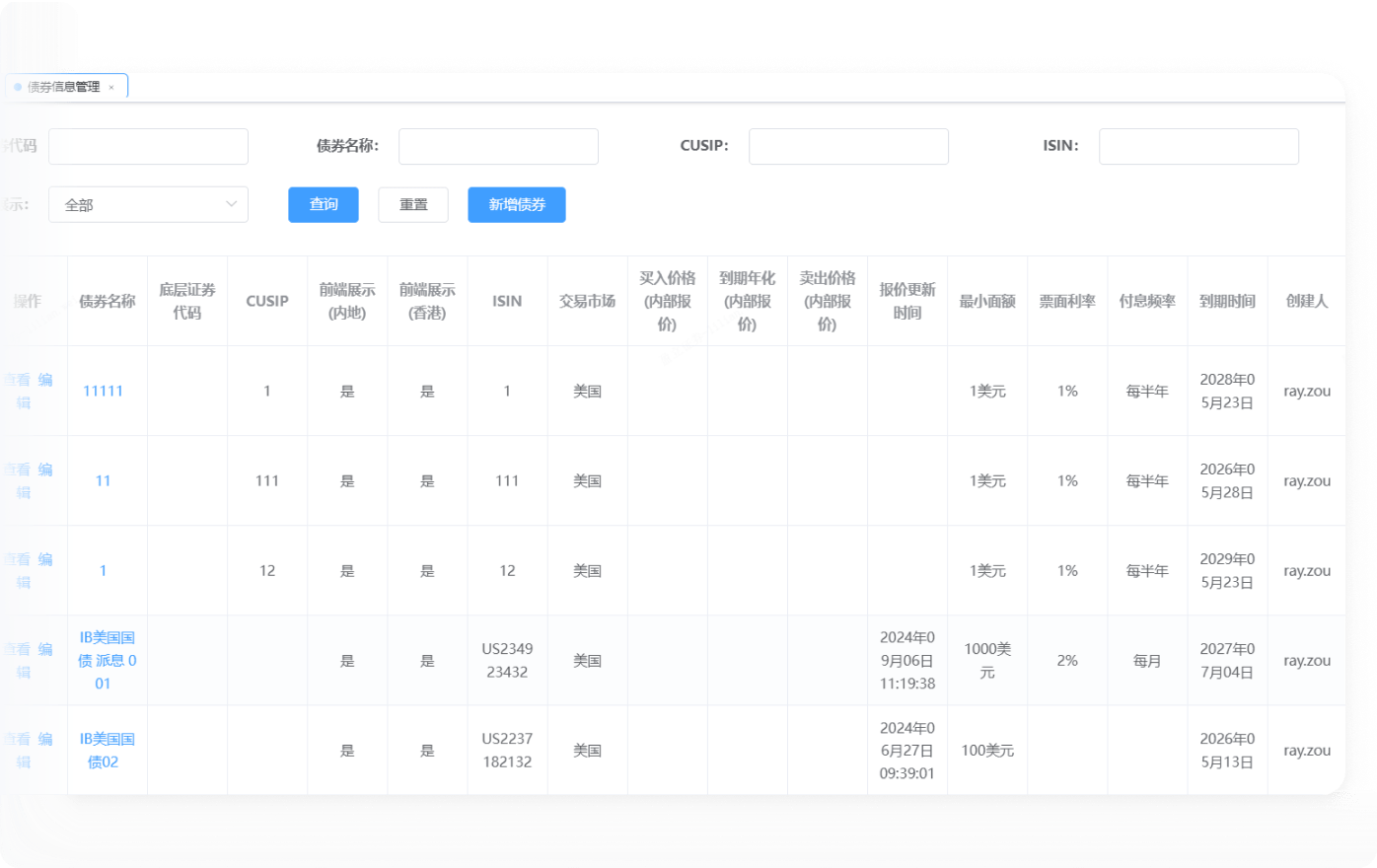

Bonds Management

Bond Counterparty Management

Bond Information Management

Bond Transaction Management

Bond Position Management

Bond Interest Payment Management

Bond Home Release

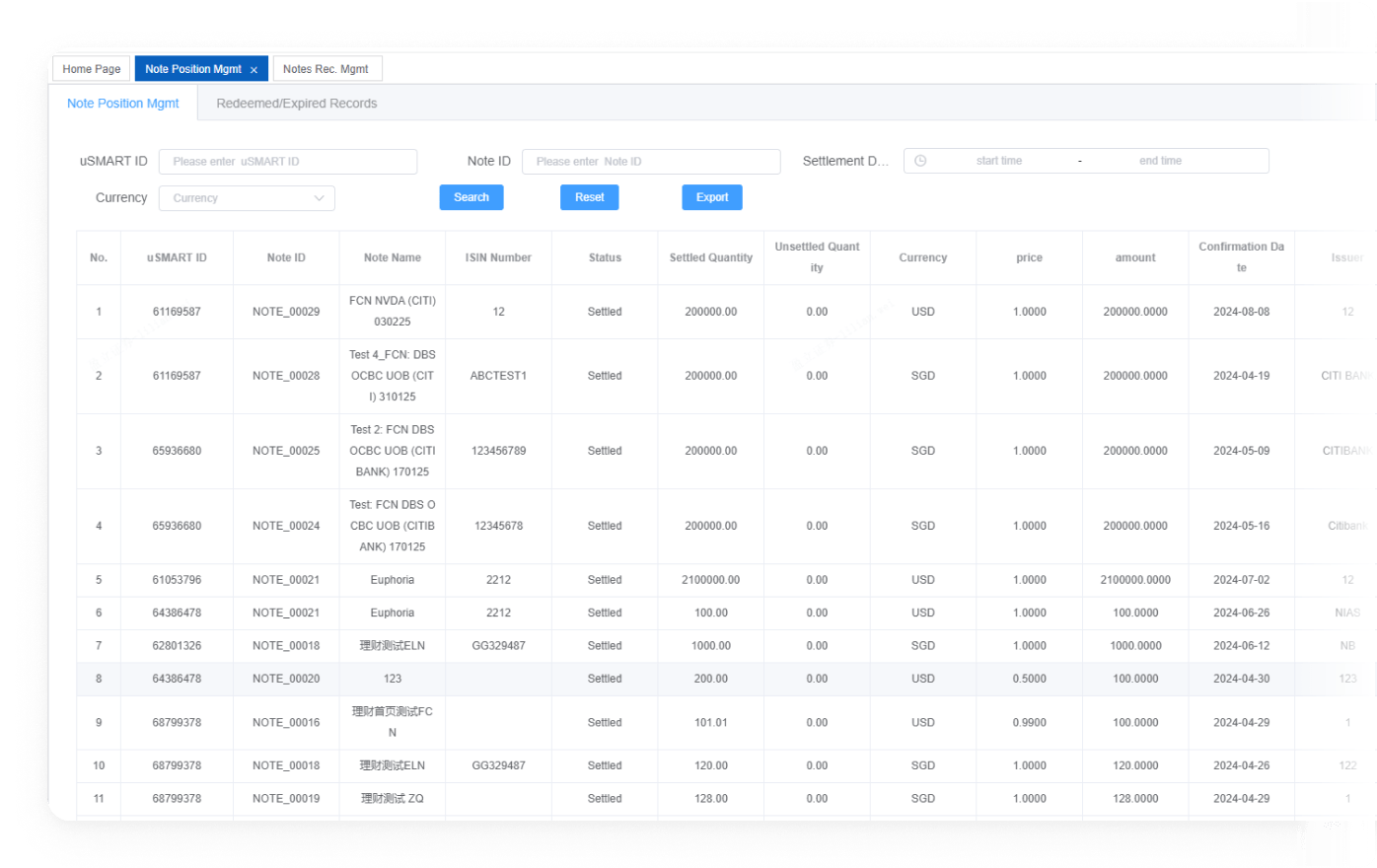

Notes Management

Note Recommendation Management

Note Recommendation Management

Note Transaction Management

Note Position Management

Note Template Management

Note Home Release

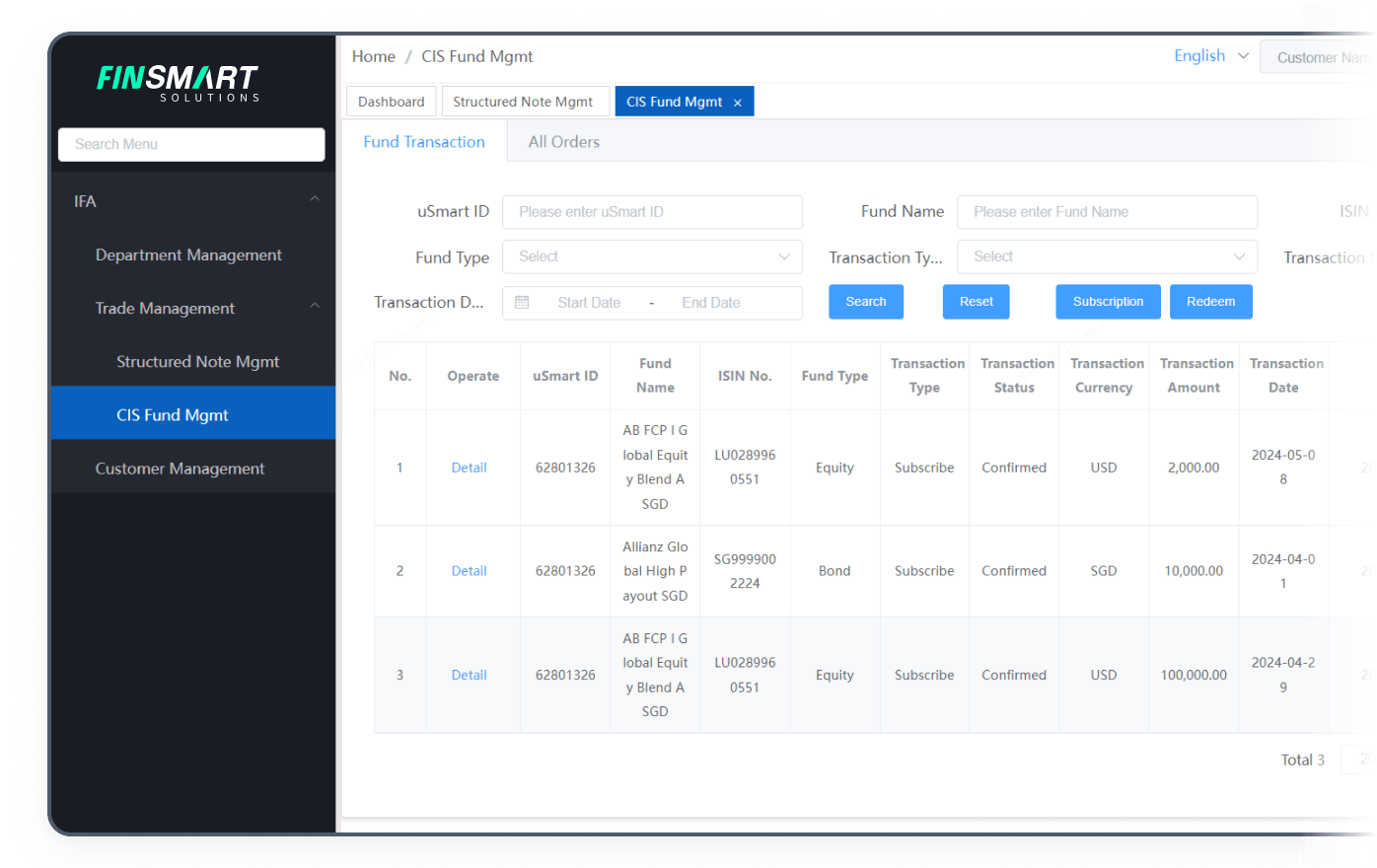

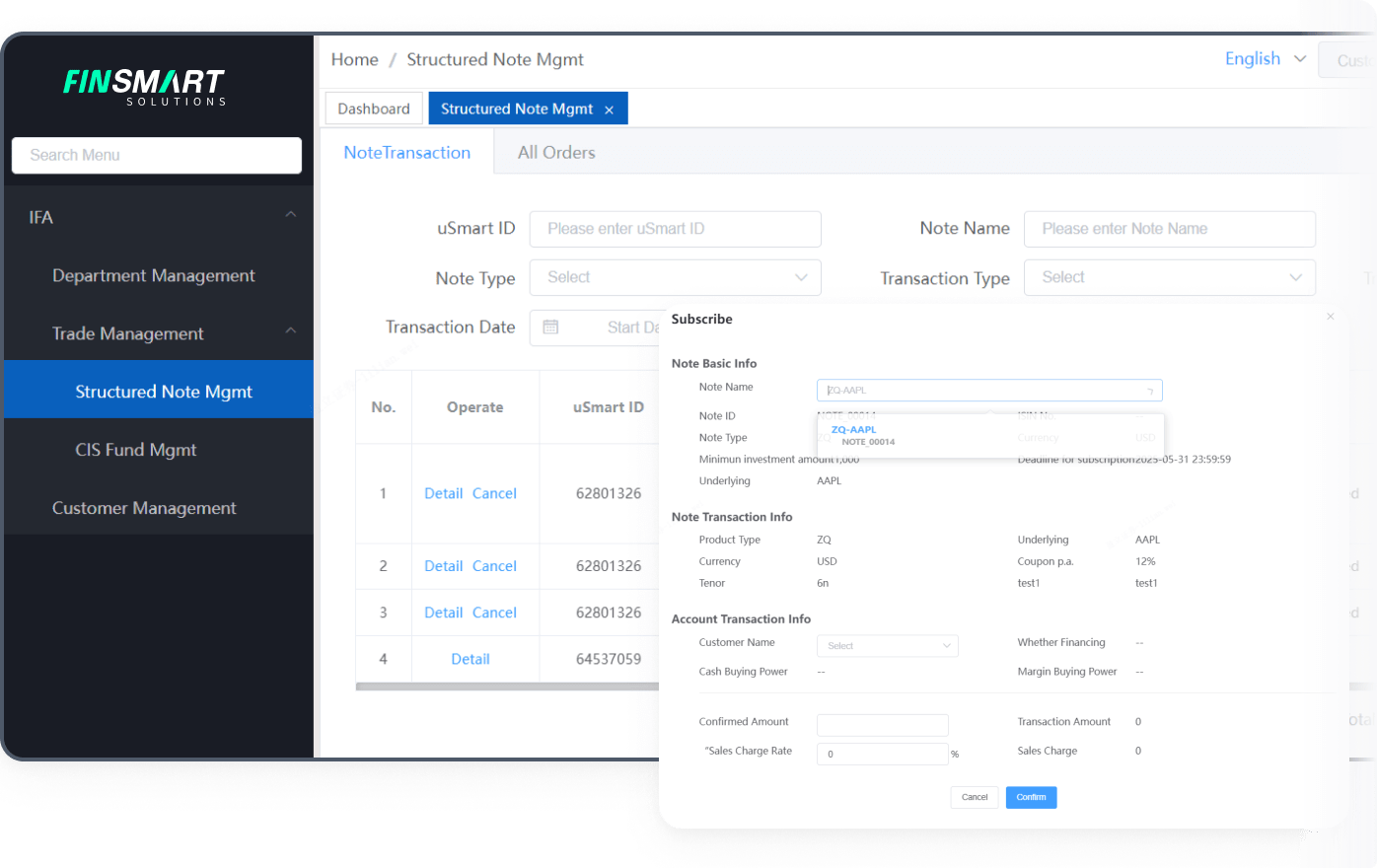

Independent Financial Advisor

Structured Note Mgmt

Record the basic information of structured notes, such as note number, issue date, maturity date, face value, denomination currency, etc.

Record the transaction information of structured notes, including transaction time, transaction price, transaction quantity, purchase and sale direction, etc. Conduct full tracking of the transaction process to ensure the compliance and accuracy of the transaction.

CIS Fund Mgmt

Record basic information of CIS Funds, including fund name, code, inception date, fund manager, investment type (e.g. equity, bond, hybrid, etc.), risk level, etc.

Maintain all transaction records of CIS Funds, including transaction time, transaction type, transaction amount, share changes, etc.